A

Different Kind

of Exit.

Hillcreek Capital is an entrepreneur-led, investor-backed firm seeking to acquire and operate one exceptional business.

Hillcreek was formed out of the following beliefs:

01

Every business will transfer; it's not a matter of if, but when.

02

The mark of a great business is its ability to continue beyond its founder.

03

There are more paths to exit than ever, but few that honor legacy, preserve culture, and prioritize people.

04

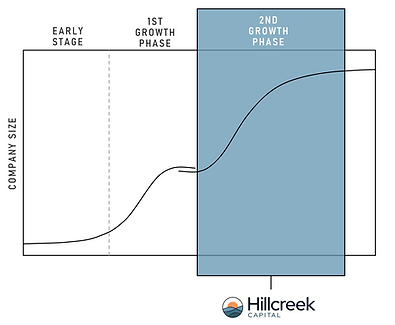

Entrepreneurial succession best positions businesses to not only survive, but thrive.

We are backed by institutional capital, but consolidating or flipping isn't a part of our playbook.

Our terms and structure are flexible, but we have the network and experience to drive the business forward.

We seek to preserve the company you have already built and opportunistically grow it over time.

EXCLUSIVITY

Your business will be Hillcreek's sole investment. Upon close, we will relocate to your community and dedicate 100% of our time to operating.

FLEXIBLE TERMS

We will seek a structure that fits your financial and estate planning needs. This can include opportunities to share in the future success of the company (as desired).

HONESTY + TRANSPARENCY

No Wall Street bankers, no used car salesmen. Our terms will be clear and we will honor our commitments. When issues arise, we will conquer them together.

PEOPLE FIRST

Your employees are vital to the future success of the company, and our desire is that they continue to grow and flourish alongside the company.

LONG-TERM FOCUS

We aren't a turnaround firm looking to "flip" your company or strip it for parts. We will seek to build on your foundation.

SHORT TRANSITION

Unless you wish to remain involved, we'll work together to clearly define a transition timeline that that ensures we're set up for success without dragging things out.

Our Commitment

Meet the Team

Austin Yates

FOUNDER

Austin is the founder and managing partner of Hillcreek Capital. Austin was raised in rural Arkansas by a loving family who valued character above all else. Over many summers spent building, fixing (breaking?), and selling things, he developed a passion for entrepreneurship and an appetite for risk.

Austin's professional experience lies at the intersection of strategy, operations, analytics, and technology. Most recently, he hired and lead an operations team at a financial technology startup, supporting the organization as it profitably scaled to over 450 employees and half a million customers. Prior to this, he worked as a consultant helping large healthcare organizations implement and operationalize new technology.

Austin earned his MBA from The University of Chicago's Booth School of Business with concentrations in Entrepreneurship and Operations, during which he completed an extended internship with Tesla Motors. He earned his bachelor's degree from Harding University with majors in Finance and Accounting.

Austin's fiancée, Caroline, is a pediatric nurse and the unsung hero of his entrepreneurial endeavors. They are getting married in October 2023.

On the weekend, you might find Austin reading at a coffee shop, playing the guitar, golfing, or rooting for the Arkansas Razorbacks. His Christian faith is the most important thing in his life; the driving force behind his desire to positively impact the world through business.

Capital Partners

Hillcreek's capital is not anonymous; our investors comprise former business owners and operators with decades of experience who now invest through the medium of talented human capital. Their investments in Hillcreek represent a belief in Austin's ability to identify, lead, and grow an exceptional business, and they have provided committed capital to support these efforts.

Collectively, Hillcreek's investors have executed hundreds of successful small business transactions across dozens of industries - far more than any single private equity firm over the same time period, and with better outcomes on average. They will take an active role in the acquired company, serving as mentors and board members and using their broad networks to assist in scaling the company.

Click below to learn more.